does texas have inheritance tax 2021

Fortunately Texas doesnt have an estate tax and is one of the dozens of states without it. Does Texas Have Inheritance Tax 2021.

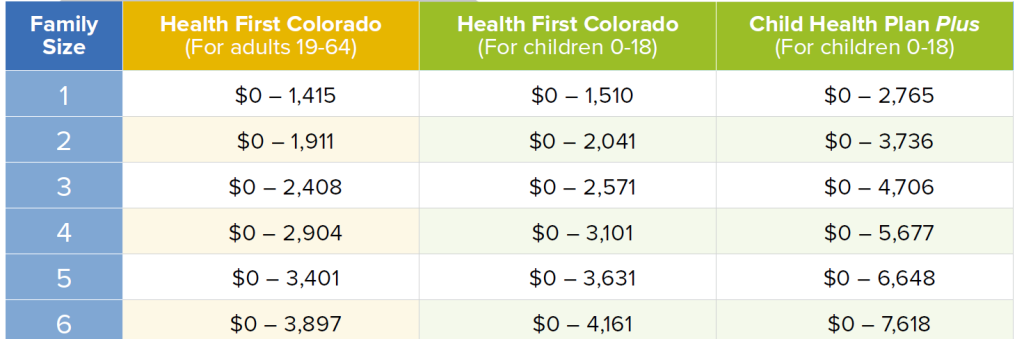

Are You Eligible For A Subsidy

Estate tax applies at the federal level but very few people actually have to pay it.

. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Married couples can shield up to 2412 million together tax-free.

As of 2021 only six states impose an inheritance tax and. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Many states have an inheritance tax that must be paid in addition to the federal estate tax but not Texas.

The law considers something a gift if ownership changes without the receiver paying the fair market. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of TexasThere is a 40 percent federal tax however on estates over 534 million in value. On the one hand Texas does not have an inheritance tax.

Maryland is the. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. Many states have an inheritance tax that must be paid in addition to the federal estate tax but not Texas.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. For 2021 the IRS estate tax exemption is 117. There is a 40 percent federal tax however on estates over 534 million in value.

Although some states have state estate inheritance or death taxes at a lower threshold Texas follows the federal. Youre in luck if you live in texas because the state does not have an inheritance tax nor does the federal government. Since there are two of them the estate tax.

Estate tax applies at the federal level but very few people actually have to pay it. Many states have an inheritance tax that must be paid in addition to the federal estate tax but not Texas. As of 2021 the federal estate tax only kicks in once the deceaseds estate is valued at above 117 million.

Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. 4 the federal government does not impose an inheritance tax. There is a 40 percent federal tax however on estates over 534 million in value.

No estate tax or inheritance tax. As of 2022 if an individual leaves less than 1206 million to their heirs they wont have to worry about paying any federal estate tax in the US. Gift Taxes In Texas.

As noted only the wealthiest estates are subject to this tax. Texas does not have an inheritance tax meaning no death-related taxes are ever owed to the state of Texas. There is a 40 percent federal tax however on estates over 534 million in value.

Twelve states and washington dc. There is a. But there is a federal gift tax that people in Texas have to pay.

However a Texan resident who inherits a property from a state that does have such tax will still be responsible for paying the relevant tax due. You can give a gift of up to 15000 to a. Does Texas Have an Inheritance Tax.

Anything over these amounts will be taxed at a rate of 40. Does Texas Have Inheritance Tax 2021. In 2020 the exemption was 1158 million per individual 2316 million per married couple.

MoreIRS tax season 2021 officially kicks off Feb. 4 the federal government does not impose an inheritance tax. Also called a privilege tax this type of income tax is based on total business revenues exceeding 123 million in 2022 and.

In 2022 there is an estate tax exemption of 1206 million meaning you dont pay estate tax unless your estate is worth more than 1206 million. The top estate tax rate is 16 percent exemption threshold. The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received.

The exemption was 117 million for 2021 Even then youre only taxed for the portion that exceeds the. Iowa Kentucky Nebraska New Jersey Maryland and Pennsylvania. How much can you inherit without paying taxes in Texas.

The Texas Franchise Tax. There is a 40 percent federal tax however on estates over 534 million in value. Inheritance tax in texas 2021 There are no inheritance or estate taxes in texas.

Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses. However in texas there is no such thing as an inheritance tax or a gift tax. For 2021 the IRS estate tax exemption is 117 million per individual which means that a person could leave 117 million to her heirs and pay no federal estate tax while a married couple could collectively shield234 million.

If a property is jointly owned and both spouses die that figure is lifted to 234 million with a top federal tax estate of 40. The rate increases to 075 for other non-exempt businesses. However in Texas there is no such thing as an inheritance tax or a gift tax.

There is a. Right now there are 6 states that have an inheritance tax. Inheritance taxes in Texas.

Inheritance taxes in Texas.

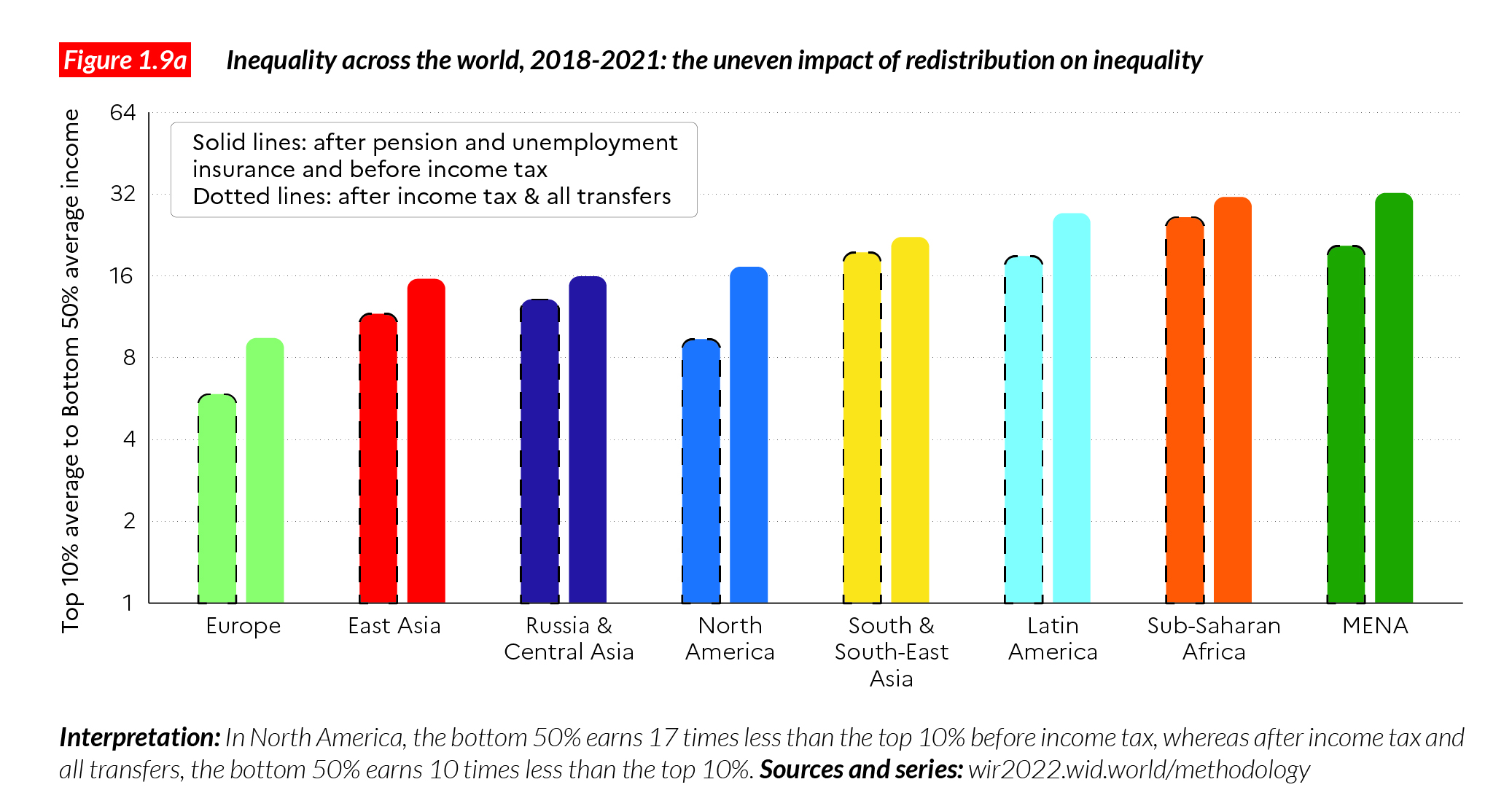

The World Inequalityreport 2022 Presents The Most Up To Date Complete Data On Inequality Worldwide

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

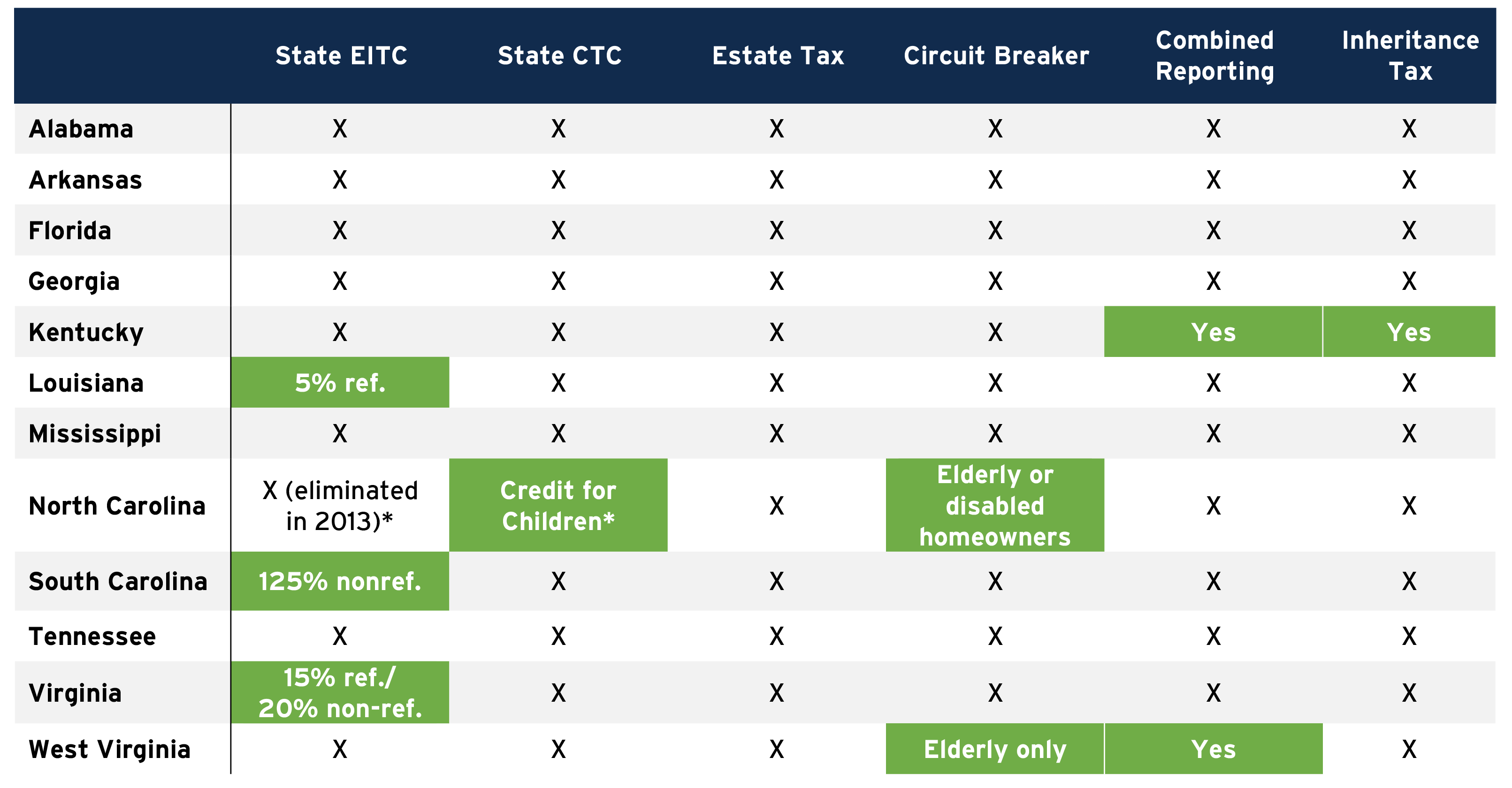

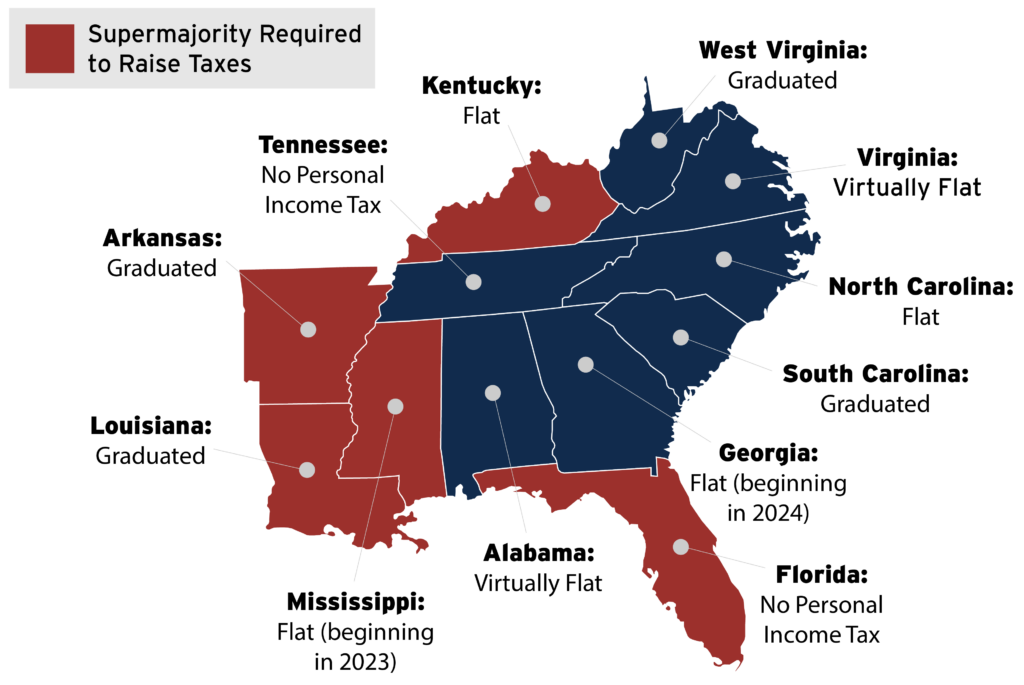

Creating Racially And Economically Equitable Tax Policy In The South Itep

New Mexico Income Tax Calculator Smartasset

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

25 6 1 Statute Of Limitations Processes And Procedures Internal Revenue Service

Creating Racially And Economically Equitable Tax Policy In The South Itep

How Do State And Local Individual Income Taxes Work Tax Policy Center

How To Avoid Estate Tax For Ultra High Net Worth Family

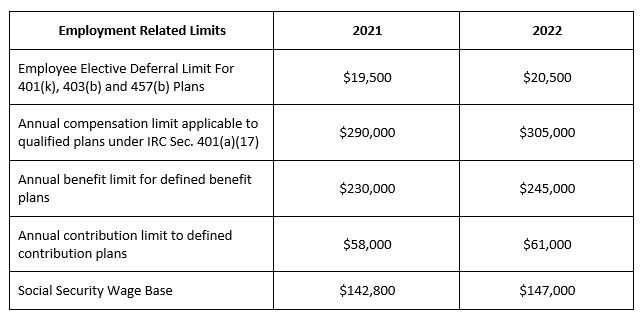

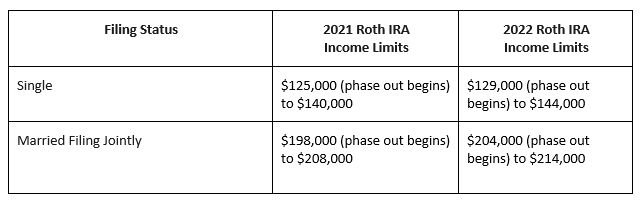

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax United States

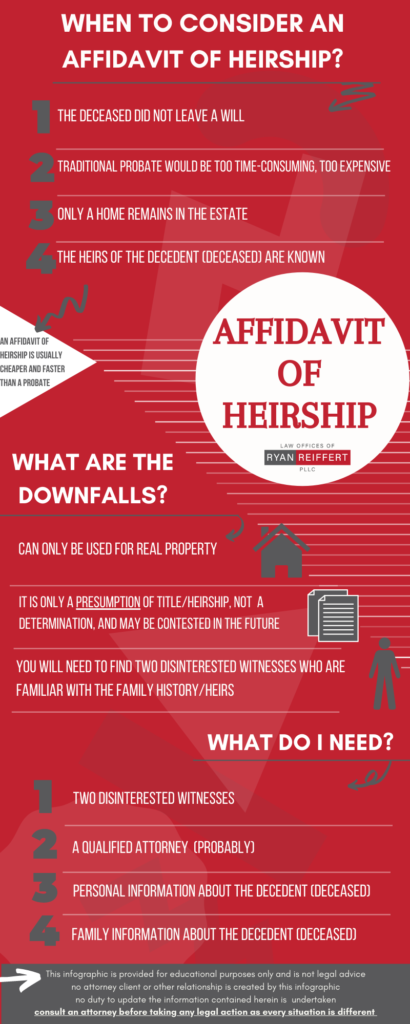

Affidavits Of Heirship 101 Ryan Reiffert Pllc

Best And Worst State Business Tax Environments 2021 The Tax Foundation

Irs Provides Tax Inflation Adjustments For Tax Year 2022 Income Tax United States

Farm Estate Planning Farm Succession Planning Open Advisors

Creating Racially And Economically Equitable Tax Policy In The South Itep

Creating Racially And Economically Equitable Tax Policy In The South Itep

How Do State And Local Individual Income Taxes Work Tax Policy Center